Volvo shares jump 21% on higher sales, plans to stop Polestar funding

[ad_1]

A Volvo C40 Recharge electric SUV is on display during the Volvo “A New Era of Volvo Cars” press conference at The Shilla Seoul on March 14, 2023 in Seoul, South Korea.

Han Myung-gu | Wireimage | Getty Images

Volvo Cars shares surged more than 21% on Thursday after the Swedish automaker announced that it will stop funding subsidiary Polestar Automotive.

Volvo earlier in the day reported a 10% year-on-year increase in fourth-quarter net sales to 148.1 billion Swedish krona ($14.16 billion), bringing its full-year 2023 total to 552.8 billion krona.

The group may hand stewardship of the ailing luxury car brand over to majority Volvo shareholder Geely Holding, Volvo Cars said on Thursday, according to Reuters.

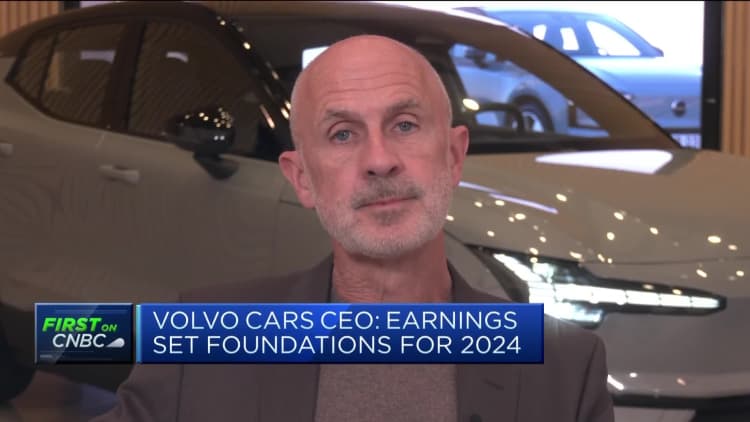

“This is a natural evolution, I think, between the relationship between Polestar and Volvo. Obviously, we spun out Polestar as a separate company a long time ago, and since then we’ve been incubating and working with Polestar for a number of years,” Volvo Cars CEO Jim Rowan told CNBC’s Silvia Amaro on Thursday.

“Now, Polestar … they’ve have got a very exciting future ahead of them, they’ve moved from being a one-car company to a three-car company, they’ve got two brand new cars coming out very shortly, in fact in the first half of this year, and that’s going to take them to a new growth trajectory.”

He said this felt like the right time for Volvo Cars to begin reducing its shareholding of Polestar and for the company to “look for funding outside of Volvo.”

“That allows us and Volvo as well to fully focus on our growth journey, especially some of the technology investments that we need to make in the next two-three years.”

[ad_2]